Have you ever stopped to wonder what’s stopping you from buying anything you want? You’re not alone. In a world cluttered with must-haves and gotta-gets, walking the tightrope between want and need can be a circus act. Let us guide you through the art of splitting your paycheck, so you can have your cake and eat it too!

Planning Your Spending: How to Straddle between Wants and Needs

Planning your spending is like planning a journey. You have a destination, but how you get there depends on how you manage your resources.

So, how do you plan effectively?

- Understanding the Difference: Separate your wants from your needs. The global smartphone is an enchanting creature, but do you need the latest model?

- Setting Goals: Understand your short term and long-term goals. Do you want to splurge on that vacation next summer or start saving for retirement?

- Boxing the Expenditure: Set monetary limits on your wants and needs. By doing this, you harness control over your spending.

Creating a System: It’s Easier than You Think

Creating a system might sound mechanistic, something only an accountant on steroids would do, right? Not really.

So, How Do You Create a Spending Formula?

- Carve Up Your Paycheck: From your Take-Home Salary, take 50% for your needs, 30% for what you want, and 20% for savings and dues.

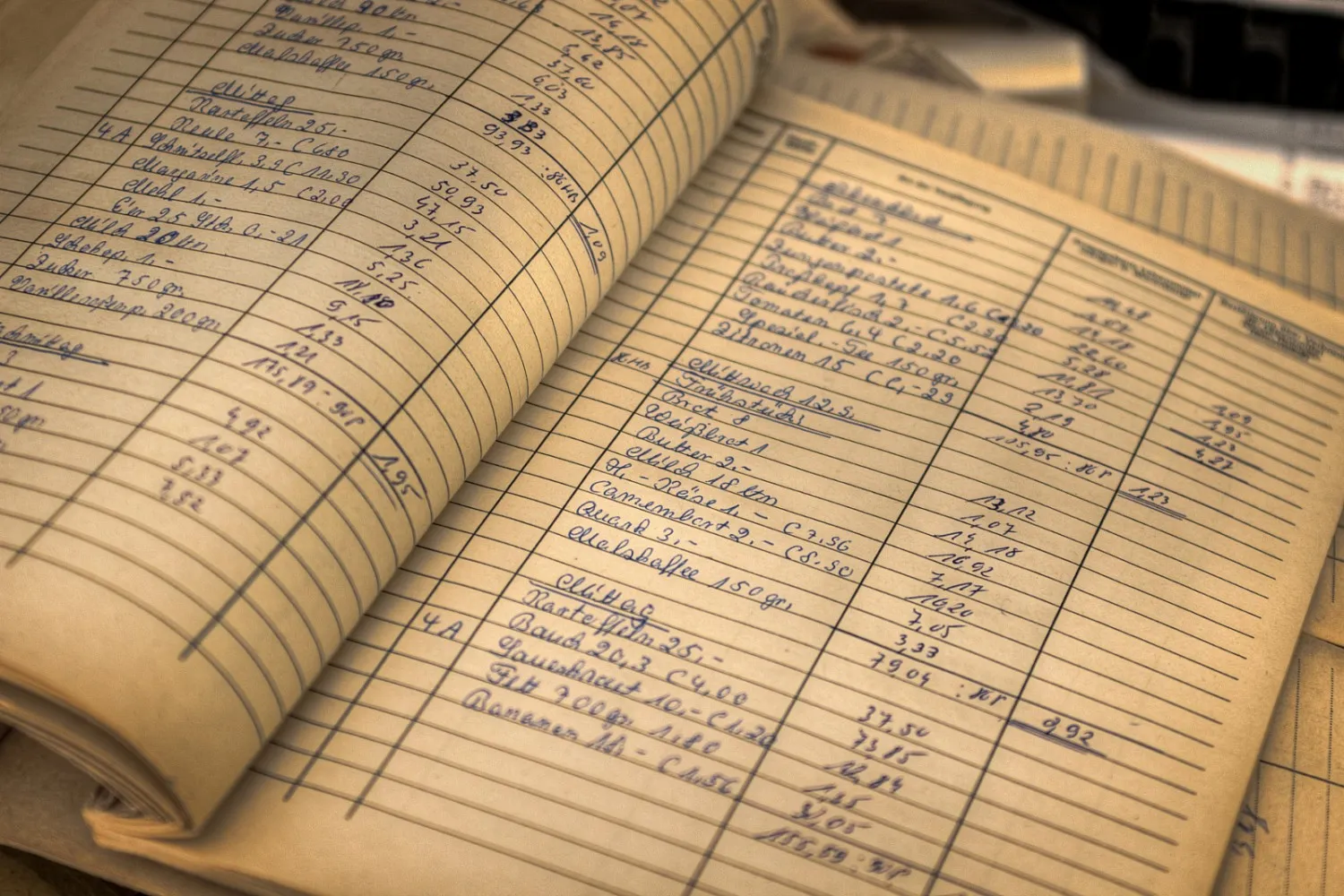

- Draft A Budget: It’s essentially a blueprint of your money allocations. Know your spending and track your costs.

- Stick To Your Plan: Like a loyal watchdog, your budget will keep you on track.

Tricks of the Trade: Making the Most Out Of Your Money

Just like any good magician, you need to know the tricks that can transform your money management. Here’s how:

Do You Want to Make Your Money Work Harder?

- Consider Investing: Putting your money to work might just be the best decision you ever make. Investments could help grow your savings over time.

- Don’t Ignore Discounts: Discounts save money. It’s pretty simple. Never pass up the chance to spend less.

- Consider a Side Hustle: More streams of income equate to more financial resources, helping you contribute to your wants and needs.

Frequently Asked Questions

What if my paycheck fluctuates every month?

If you have a variable income, make a budget based on your lowest paycheck. This way, you’re prepared even in worst-case scenarios.

Is it wrong to occasionally deviate from my budget and splurge?

As long as you’re maintaining a healthy savings account, an occasional indulgence isn’t a bad thing. It keeps the journey enjoyable.

Are You Ready to Flex Your Financial Muscles?

It’s been quite a rollercoaster ride, hasn’t it? We hope that these insights serve as a map on your journey towards financial freedom. Remember, the goal isn’t to restrict your spending, it’s about empowering you to make informed choices. Go on, start splitting your paycheck for all you want (and save for what you need)!